European Hotel Barometer – 2022 beats expectations

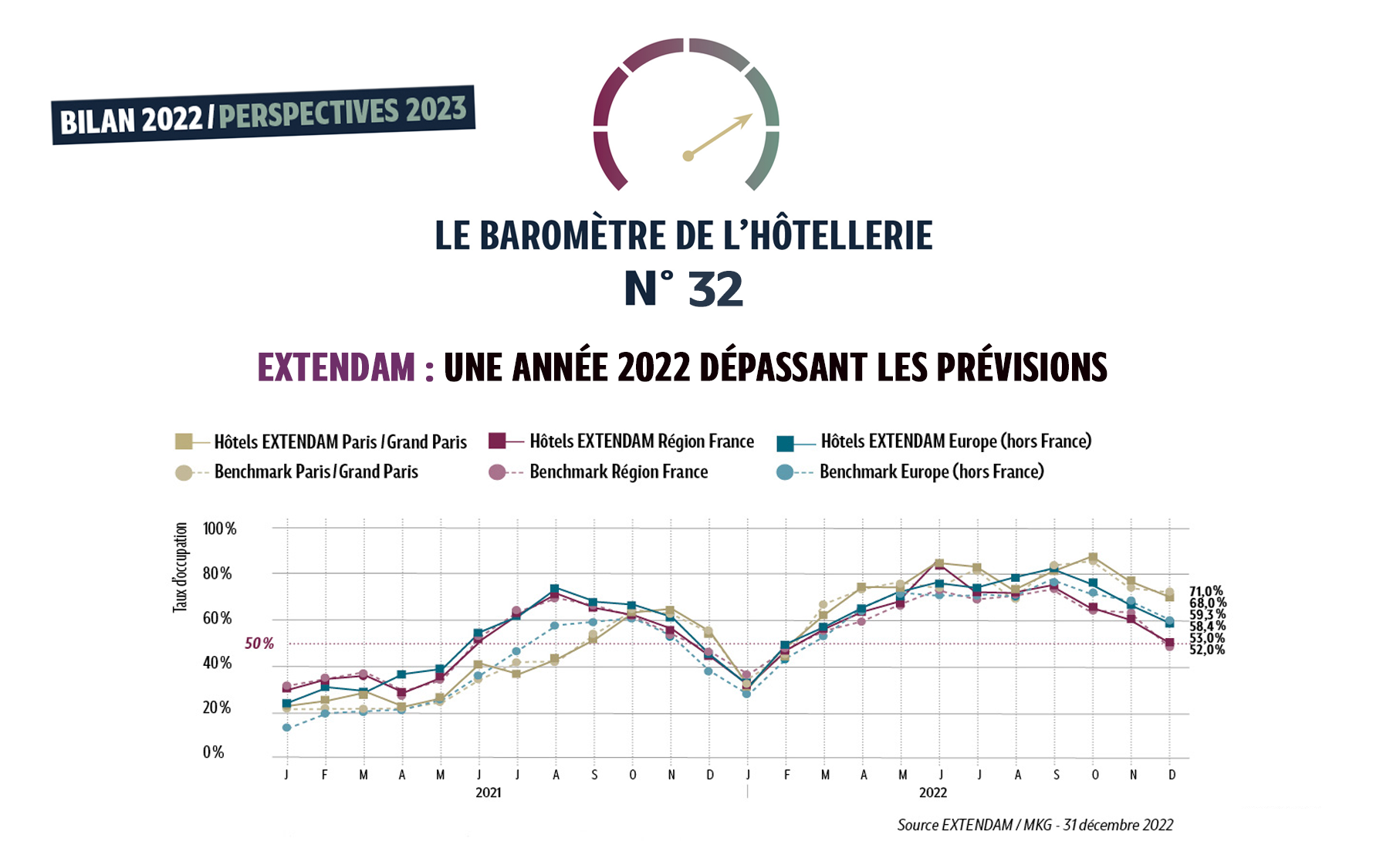

Less than a year ago, hotel market experts were wondering how long it would take to emerge from the health crisis, with outlooks for 2023 and 2024 varying widely. In fact, 2022 beat expectations and the most optimistic forecasts are now daring comparisons with 2019, a record-breaking year that has become the hotel market benchmark.

2022 was outstanding and will go down in history as a year of recovery throughout Europe and across all segments. Leisure and business travel resumed and international travellers returned gradually, with revenge travel providing a welcome boost. Despite a challenging economic backdrop and geopolitical unrest, 2022 also marked a return to seasonality in the industry and greater market clarity.

Increasing occupancy and a sharp rise in average daily rates

While the market as a whole has not returned to its 2019 occupancy levels, average daily rates have far exceeded expectations. RevPAR is increasing and has even hit new highs.

Europe closed the year on an occupancy rate of 59% as of 31 December 2022 and an average occupancy rate of 65% (versus 72% in 2019) while average daily rates soared to €110 as of 31 December to settle at a full-year average of €109 (versus €96 in 2019).

France posted an occupancy rate of 65% in 2022, an average daily rate of €108 and a RevPAR of €70 (+7% versus 2019). Over the last 12 months, average daily rates in France posted an increase of 14%, a performance that outstrips inflation.

While these results are driven by a clear upturn in business activity from the second quarter onwards across all segments, they also reflect the industry’s ability to adapt to inflation and highlight a fact that Covid-19 had almost made us forget: there is a structural gap between hotel accommodation supply and demand in Europe.

Greater clarity and regional catch-up

The good news is that 2022 also marked the return to seasonal fluctuations in hotel occupancy, offering greater market clarity for operators and investors. Following a sharp upturn in the second quarter, the summertime momentum lingered on as it did in 2021 and fourth-quarter figures were particularly robust, particularly in October and November. In France, although occupancy rates fell short of 2019 by 2.5 points, November 2022 was a stand-out month with an average daily rate increase of 12.5% versus 2019. This growth is especially encouraging for an off-peak period. Portugal and the United Kingdom reiterated the trend, posting respective RevPARs of +16% and +11%. Besides the return of hotel seasonality, another fundamental structural shift has materialised. The prices displayed and charged have realigned with the various hotel categories. The upscale segment is benefitting most from this shift and is returning to high average daily rates that have risen 10–23% versus 2019 depending on the region.

In France, Paris and the surrounding Greater Paris suburbs caught up with the performance of other French regions in 2023. Regions that proved resilient in the face of the health crisis saw their 2022 occupancy rate rise to 62%, further narrowing the gap with 2019 (-3 points). The average daily rate, all categories combined, rose 11% versus 2019, reaching €88. The cities of Marseille (€100), Toulon (€95), Strasbourg (€95) and Nice (€187) contributed most to this overall performance.

Greater Paris, buoyed by renewed momentum in the capital, posted a 65% occupancy rate and an average daily rate of €89. Paris achieved record RevPAR (€155, up 15% on 2019) with a high average daily rate of €205 and a 75% occupancy rate that continued to climb to end 2022 just 5 points below that of 2019. Spurred on by a successful 2022, 2023 kicked off well in terms of bookings. That being said, geopolitical unrest, inflation and rising interest rates make caution the watchword for 2023 outlooks.

ANNUAL PERFORMANCE 2022

Following a slow start to 2022 due to ongoing sanitary restrictions, hotel performance improved significantly over the course of the year. Regions saw a return to normal in terms of their respective seasonal patterns and average daily rates increased. Annual performance was uniform and this should continue in 2023.

Europe enjoyed a good start to autumn thanks to leisure travellers to the Mediterranean and healthy volumes of business travel. In September 2022, Europe had a RevPAR of €98, an increase of 10% versus 2019. Occupancy rates in Europe had increased 64% by the end of 2022.

The regions of France proudly ended summer 2022 with a RevPAR of €84 in August (+15% versus 2021). All tourist destinations were busy despite the heatwaves and forest fires. These regions posted an occupancy rate of +62% at the end of 2022.

Greater Paris experienced two major peaks in activity: June and September–October 2022. All categories combined, occupancy rates exceeded 80% while average daily rates exceeded €160, driven in particular by the return of international and corporate clients. Greater Paris ended 2022 with a 70% occupancy rate.

Regional occupancy

December, which is typically a mixed bag, fluctuated between busy and quiet periods with bookings rising 10–19 points depending on the region.

See the Covid-19 impact survey

The hotel performance barometer has been published monthly since March 2020 in collaboration with our partners: MKG Consulting, Deutsche Bank, SNCF, e-axess, D-Edge Hospitality Solutions, Flightradar24 AB, La Bourse des Vols and CDS Group.